Winners (there are a few)

It hasn’t been a great first full year for Equity Crowd Funding in Australia as detailed in this companion article So Many Losers In Crowd Funding,

However, there have been some clear winners in the race to be dominant platform for this new form of investment.

There has been some successful campaigns and the reasons for success are obvious. The successful campaigns were focused on the “crowd” element of crowdfunding and not just the “funding” element of crowdfunding.

There is also good reason to expect greater success for community-led investment and equity crowdfunding in Australia when we see deals that address a community-wide need, engage in co-creation with a community and inherently reduce the risk for each investor has more investors come on board.

So let’s take a look at the winners.

Intermediaries

There are 15 ASIC-licensed intermediaries able to list equity crowdfunding deals. They include:

Ag Crowd: AgCrowd listed Go Micro technology for insect and plant microscopy and raised $42,000

Big Start Capital: Listed 0 deals

Billfolda: 2 CSF offers. The first withdrawn due to a wholesale funding agreement and one fully funded in 5 days with 49 investors

Capital Labs: has 1 deal currently listed, but throughout 2019, 0 deals

Crowd 88: 2 deals – Enova Energy and a Documentary about Brabham.

CrowdFunding.com.au: 0 deals

Enable Funding: 1 deal for Australian Mortgage Marketplace

Fundsition: 0 deals

Galaxy Crowdfunding: 0 deals

Pulse Markets: 0 deals

Venture Crowd: It is hard to determine how many deals for this platform as they operate syndicated investment outside of the equity crowdfunding regime and are licensed within it too. However, it looks like they have 0 deals via the equity crowdfunding regime and all 2019 deals were done via their other syndication services.

PledgeMe: 5 Deals including Food Connect, Ethical Dairy, Biodynamic Farming and Medical Cannibas. This platform has a focus on “New Economy” businesses and raised >$5m in total.

OnMarket Book Builds: 8 Deals raised in aggregate $6.4m. This platform as the name suggests helps private companies pre IPO book building capacity.

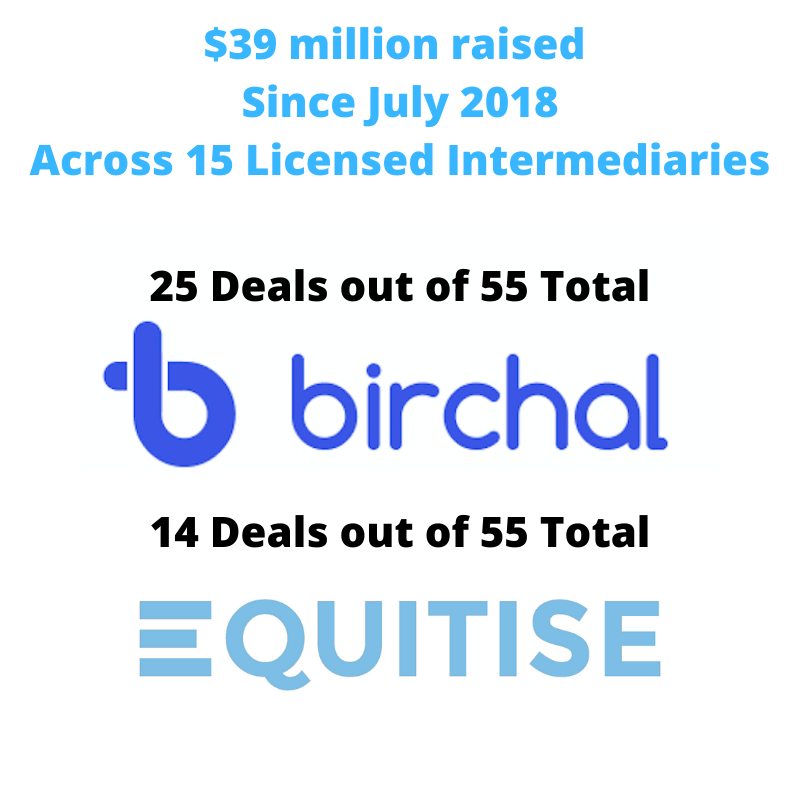

Equitise: 14 Deals raised in aggregate $10m. This included Just under $5m for Xinja neo bank over tranche 1 and tranche 2. This platform has a focus on technology startups with a potential to become unicorns.

Birchal: 25 Deals raised in aggregate >$16m. This platform is related to Pozible the dominant rewards crowd funding platform. This platform has a focus on consumer brands where rewards in addition to equity can be offered to investors. This platform has out-performed the rest of the market significantly.

In aggregate, there were 55 deals that raised $39m in funding via equity crowdfunding since the introduction of the laws (a bit more than a year).

Settling Or Failing?

Birchal with nearly 50% of the market and Equitise with 35% of the market are clearly the dominant platforms.

Australia is a mirror of the UK markets where Seedrs and CrowdCube are the dominant platforms.

Over the long run most markets settle down to a couple of bigger players. What is interesting about this market is that “settling down” has happened in the first year and that nearly 50% of the licensed platforms (that each paid significant licensing costs), didn’t even post a deal.

Perhaps there will be more competition in 2020.

Perhaps we’ll see a few licenses lapse or perhaps the regulations will change in response to what must be seen as under-whelming results.

Birchal Success

Birchal has come out of the most successful reward crowdfunding platform in Australia (Pozible). Birchal with its customer-centric and consumer-brand focused platform has been the clear winner so far amongst the intermediaries. Part of why has to do with providing rewards as well as equity to the community of supporters.

The other reason is to do with valuations.

A business with 1000 people on a customer database is good. But it has less value in terms of Lifetime Customer Value (LCV) that does having 1000 people that contribute to a rewards crowdfunding campaign like (buy a brick), which in turn has less value than 1000 shareholders who own a small part of the brewery.

The Lifetime Customer Value of each shareholder is worth more to the valuation in the next round than just the value of the capital. In this way, consumer brands are buying customers when they get shareholders. Any potential acquisition of the company will consider evidence of not just how many people are on that companies marketing list, but also how “bought in” those customers are and nothing is as bought in as being a co-owner.

This strategy is what has worked overseas with businesses like BrewDogs.

Australians Like To Drink

Australian drinkers and the companies supplying those drinks have taken to equity crowdfunding. The winning category would have to be beer. Men in particular want to own part of a brewery.

20% of all the equity crowdfunding deals so far and just under >$5m (<20%) of the total $39m raised in 2018-2019 went to 5 craft breweries, a champagne maker, a gin maker and an upper-end soft drink maker.

These businesses are obviously looking at the improvement in Lifetime Customer Value (LCV) and the funding provided by equity crowdfunding and liking what they see. It is also true that Australian’s like to drink.

Equity crowd funding for beer and skittles is a far cry from what the promise of equity crowd funding was when proposed.

You’d have to wonder if this will extend to the point that the hundreds of craft brewers in Australia can have hundreds of shareholders and in turn support a healthy crowdfunding industry. Doubtful.

Future Winners

Successful crowd funding requires

- A community need

- Community co-creation and

- De-risking via community participation

Shebah – the “All-female Uber” is an example of getting this right.

Shebah addresses a real community need. Women need to feel safe (and currently don’t).

Rideshare when finishing a late shift, when organising for kids to get to and from activities or supporting other women (Shebah drivers) means Shebah is distinct from Uber. Shebah addresses this need with a simple solution. Police-checked, working-with-children-certified, all-female drivers.

Shebah co-creates with its community.

In fact most of it’s shareholder are also drivers. The pool of Shebah Drivers who are also Shebah Shareholders gets the investment over the long-term, but also get reduced commission on already generous terms for driving with Shebah.

Driver-shareholders feel they own the platform. They have an actual stake.

They feel comfortable and confident sharing ideas, service improvements and have “bought in” to this business far more than say Uber drivers have been able to buy-in to Uber.

Shebah is de-risking.

Shebah has also improved the underlying business value proposition with equity crowd funding.

As the equity crowdfunding campaigns have had such success and associated PR, the network of drivers has grown, the satisfaction of drivers has grown and the availability of drivers for the all-female clientele has grown. This improves the service and reduces wait times. This in turn reduces risk of the investment for the whole community.

Not Unicorns

It looks from the evidence that equity crowd funding is not going to be a unicorn breeding farm. That’s because there are So Many Losers In Crowd Funding.

Instead, equity crowd funding might find success supporting crowds to fund the things they collectively want to see happen in the world.

Or more importantly (against a backdrop of climate change) will help crowds create the things they need in the world.

At a local level we all need Energy, Food, Water and Waste.

Businesses like Red Grid ($0.825m), DC Power ($1.62m) and Enova Energy ($1m) used equity crowd funding in the previous 12-months to expand their renewable energy business models.

Likewise, businesses like Food Connect ($2.1m), Ethical Dairy ($0.55m) and Bring Me Home ($0.42m) (Food Rescue App) are addressing the fragile food system we currently have.

Given the drought it’s possible that Water and Waste companies will be the next to engage their community, co-create and then get funding using equity crowdfunding.

Zebras

Zebra companies are characterised by doing real business, not aiming to ‘disrupt’ current markets, achieving profitability and demonstrating it for a while, and helping to solve a societal problem. Zebras address needs of a community, are embedded in the community and co-create with their community.

Equity crowdfunded businesses may be considered ‘Zebras’ instead of “Unicorns”.

Unlike Unicorns, Zebras exist.

Zebras are interesting. Zebras are engaging.

Unlike ‘unicorns’ that promise accelerated returns to shareholders, Zebras promise fair returns. Why?

Well, for a unicorn to exist (in financial terms) it must provide an accelerated return to shareholders.

This accelerated return to shareholders must come at the expense of another stakeholder group i.e employees, customers, local communities or via an externality (externality is a cost that has been shifted to the public i.e the externality of mining and resource profits is pollution).

When you invite your community into the business you are creating a business that is less able to externalise costs or suppress other stakeholder groups in pursuit of return on investment.

Hence, Zebras not Unicorns will be the businesses to actually engage with equity crowd funding. Of course, we’ll still have the occasional beer company, tech company and consumer brand, but the drivers for growth will be

- Community Needs

- Community Co-Creation

- Risk Mitigation for each with greater participation from all

Want To Learn More

If you want to know more about the state of Equity Crowd Funding in Australia get yourself to the Common Wealth event in Sydney at UTS Centre for Business and Social Innovation on February 27 & 28. Tickets here

Day 1 of this Event Features 16 TEDx styled talks on creating common wealth building. Day 2 of this event will see the Crowd Funding Institute of Australia (CFIA) host a roundtable with industry, regulators, advisors and investors.

Want to know more about Crowd Funding Losers from the first full year of roll out.