This post is designed to take someone that doesn’t really know anything about Community Wealth Building and give you a reasonable understanding of all the elements that make it possible on a single page.

What Is Community Wealth Building All About?

Community Wealth Building is all about keeping and growing wealth locally.

This philosophy is a return to fundamentals of business and economics. It is quite at odds with the prevailing economic wisdom that says business and economics should be centralised, market-based and cheapest (at all costs).

The contrarian views within Community Wealth Building are not a fantasy though. They are rooted in commercial advantages that locally-owned, locally-produced and locally-consumed goods and services have when compared with goods and services provide by “out-of-towners”.

These economic advantages benefit the people of a specific place i.e. they stay local.

Inherently, this means that enterprises and pieces of infrastructure created through Community Wealth Building are capped in size. They don’t grow to the scale of the large Corporations that we are all familiar with. They don’t get listed on public stock markets and don’t give an accelerated return to shareholders. Instead they service people well, provide good jobs and fair returns.

Community Wealth Building has the flow-on benefits of better social and ecological outcomes (when compared with the out-of-towners).

Right now is the most exciting time to be a Community Wealth Builder in 70 years. So let’s get on and explore this topic.

Who Really Has the Advantage?

When most people think of local enterprises, they often imagine something unsophisticated. In fact, our experience is that local enterprises are often innovative and more efficient than corporate out-of-towners. Why?

- Economics: Some things are cheaper when closer to the points of production and consumption. This gives local production a cost advantage.

- Agility: Advances in the technology, software and management techniques that have enabled startups to beat larger incumbents are now available for Community Wealth Building. This has reduced the cost of establishing businesses and allows these new businesses to out compete larger corporations with their sunk costs and higher overheads. Often the cost of establishment for a new local enterprise is less than the annual maintenance costs of incumbent out-of-towners, giving local startups an incredible advantage.

- Propinquity: Propinquity describes the effect whereby a ‘place’ modifies the behaviour of people due to proximity. A nightclubber in a church is likely to behave reverently and a priest in a nightclub is still likely to sway along with the music. Propinquity provides a basis for common understanding between locals and allows community enterprises to get an efficiency in communication that out-of-towners can’t replicate.

- Marketing: Growth in any business is really down to the “cost of customer acquisition” and “lifetime customer value” of that customer. Local businesses can more effectively use word of mouth, advertising and neighbour-get-neighbour strategies that reduce the cost of customer acquisition. Also, loyalty amongst local stakeholders is usually improved increasing the lifetime customer value.

The poor “self image” of local businesses is not warranted and corporate Australia should watch out when locals recognise that they now have the economic advantages and that the large Corporates don’t.

More Than Just New Enterprises

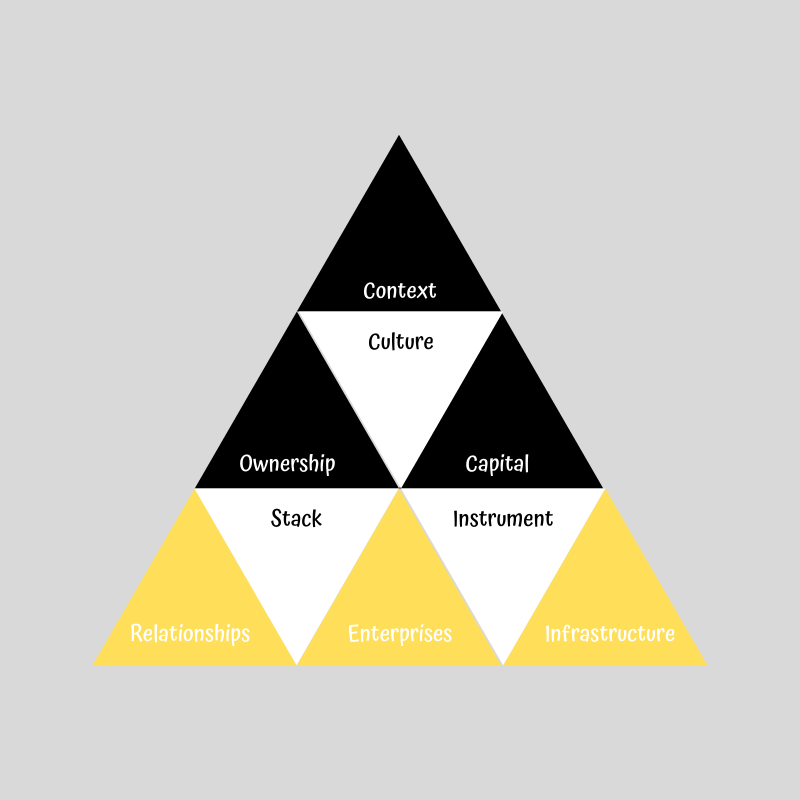

Community Wealth Building is more than just the ability for local enterprises to compete with out-of-towners. Let’s dive in and look at the broader dynamics using Ethical Fields Community Wealth Building Pyramid model.

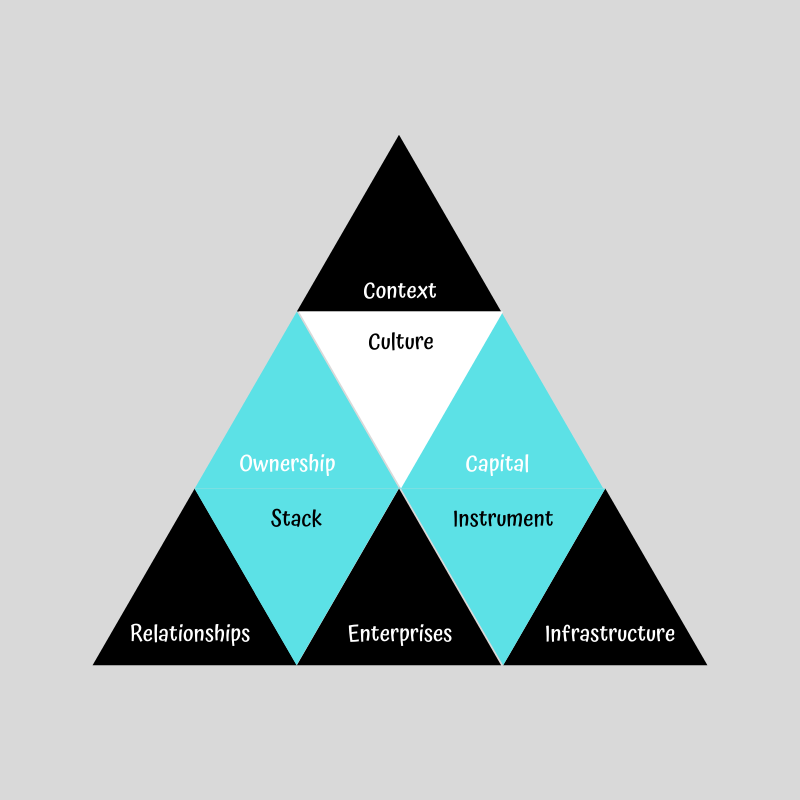

Community Wealth Building Pyramid

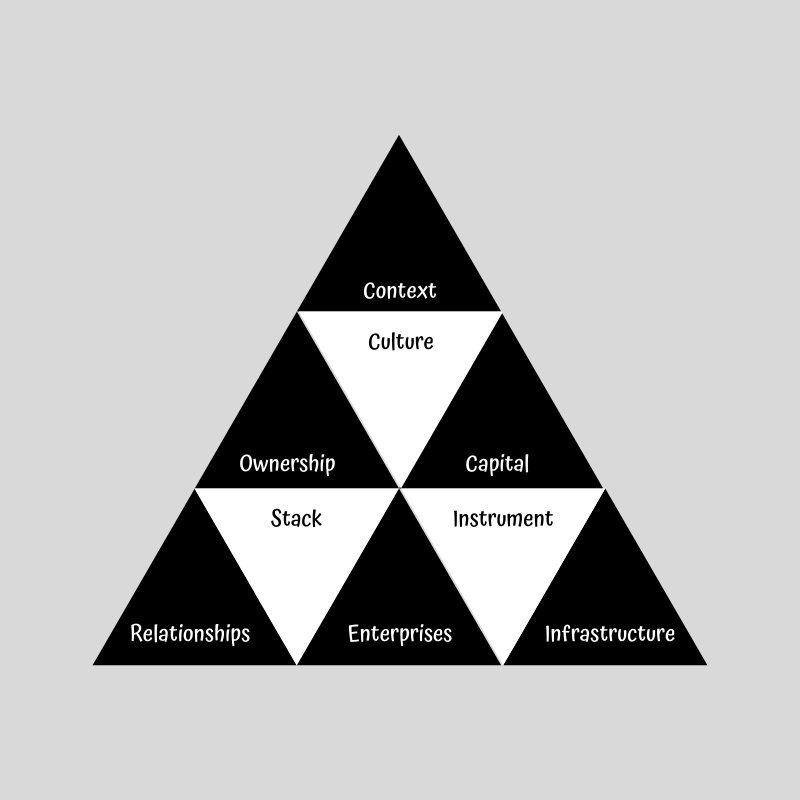

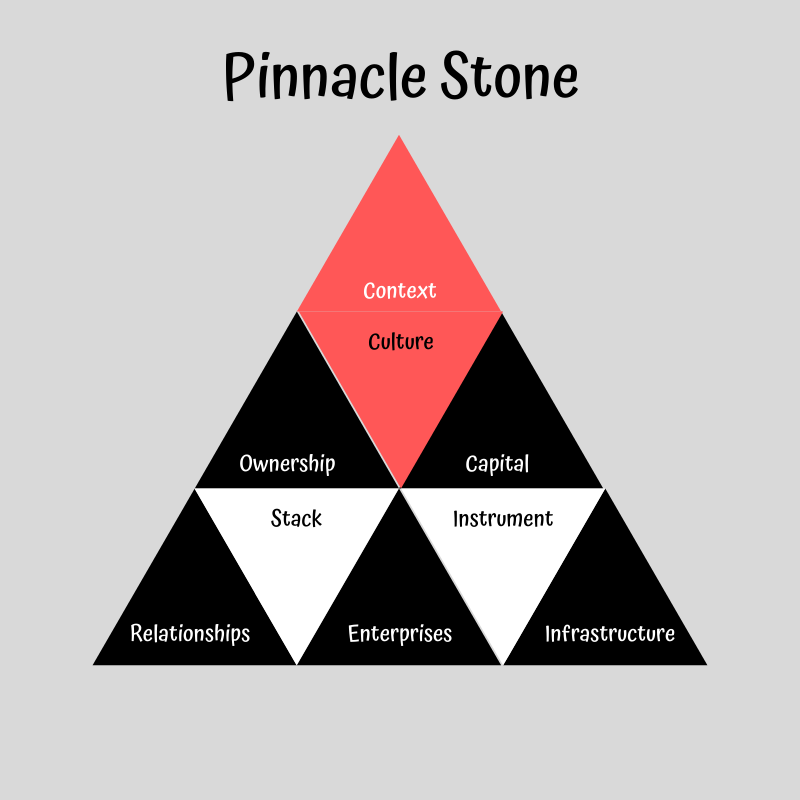

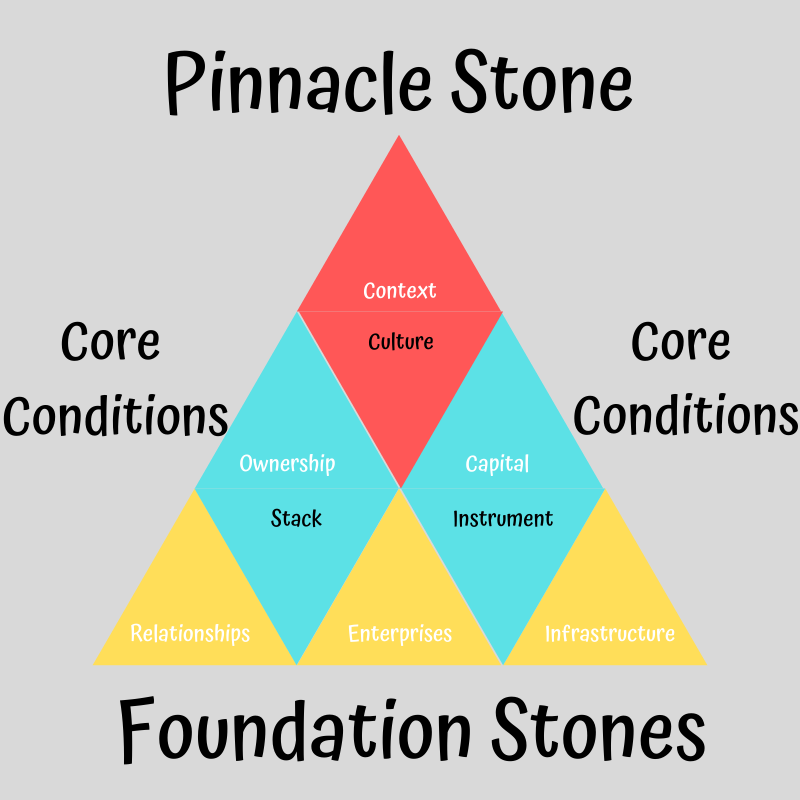

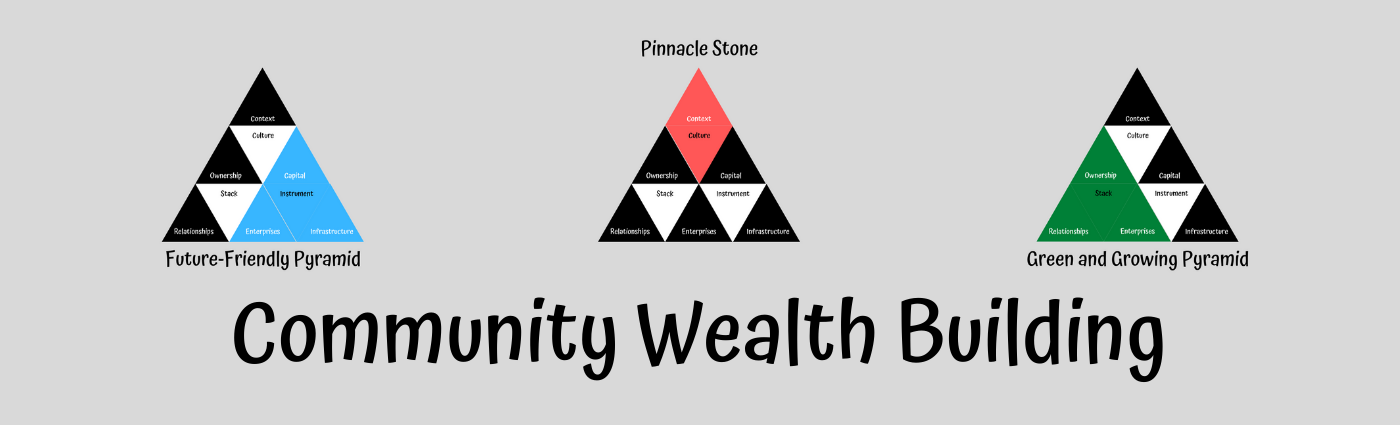

What follows is a simple model for Community Wealth Building that views the dynamics between Relationships, Enterprises, Infrastructure, Capital, Ownership, Stack, Instruments, Culture and Context as a pyramid.

Each “layer” of the pyramid is supporting and/or supported by other layers of the pyramid.

Elements are often referred to as “Stones” and what emerges are smaller, sub-pyramids.

The rest of this page will explore these interactions in some detail.

Cultural, Transactional and Ecosystem Levels

One view of the Community Wealth Building Pyramid is comprised of interacting elements.

Context

The position of this element at the top of the pyramid should shed some light on its significance.

The Context of Community Wealth Building is of utmost importance.

If the community has given meaning, purpose and significance to this endeavour, then it will provide ongoing inspiration to the more functional parts discussed on the pyramid’s lower part.

Pro Tip: What’s your why? Identify this. Articulate it and write it down. Then make it real at an individual and community level. In short, promote your ‘why’ like it’s the most important thing in the world.

Culture

“Culture eats strategy for breakfast” noted famous management consultant Peter Drucker.

Culture is often identified through the rituals, habits and norms of the people in the Community.

Is this a Community that prays, plays sport, drinks too much? Whatever the community habits are is not as important as understanding that these are the things that will dominate behaviour.

Often Culture is tied into the physical and biological resources of the surrounding area. Coastal communities tend to have a culture around the beach and surf clubs often act as a cultural centre point. In regional and agricultural centres, it may be the type of primary industries that determine culture.

Culture is also frequently misunderstood as the ‘same-ness’ of the people. But that is not what we are saying. What we have experienced was that culture is about ‘whole-ness’. The Culture of a place is the sum of the sub cultures within the place. People within a Community can and are different at an individual level, but they each take and give something to the whole of the culture of a place.

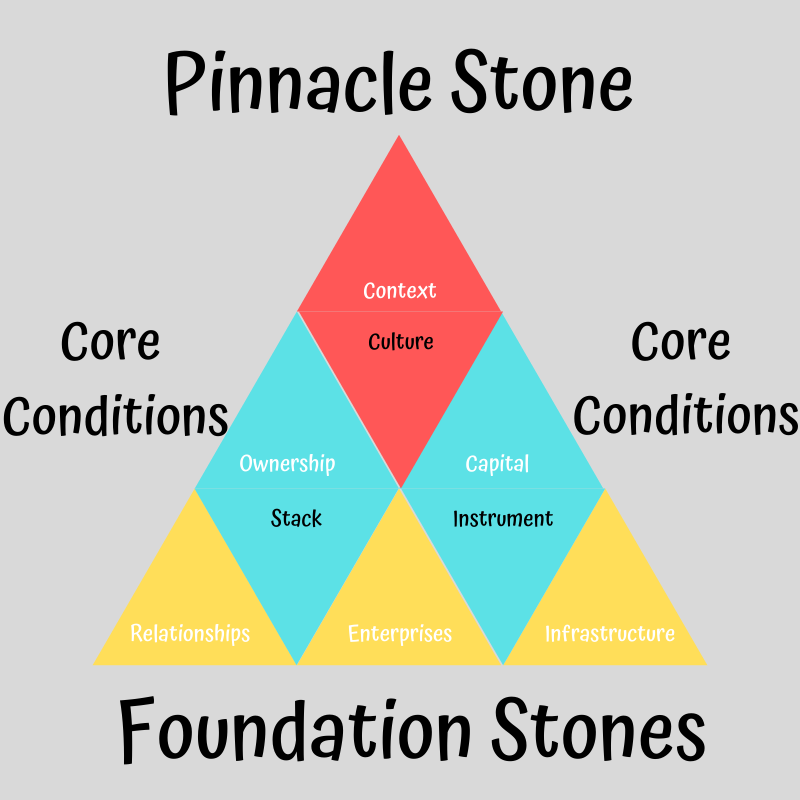

The Pinnacle Stone

When Context and Culture are considered in reference to the Community Wealth Building Pyramid, we call it the Pinnacle Stone.

Without the Pinnacle Stone being set correctly at the top the pyramid, metaphor breaks down and all you have is a pile of rocks.

Capital

There’s a golden rule that goes: The person with the gold makes the rules.

In context of Community Wealth Building, it is important that the Community provides the “gold” and sets the rules.

Currency

There are many ways of creating Capital locally and keeping it local. One such way is creating a local currency. The conversion from local currency to national currency has the ability to encourage local wealth through spending and decrease extractivism.

However, a local currency is not a silver bullet unless it is used and accepted by most of the relevant vendors. This was truly evidenced in 2017 with crypto digital currencies being created at break neck speed during the ICO boom and bust. Or with the arrival and departure of several local currencies in the UK.

Asset Securitisation

Capital, as you’ll appreciate, is vital to new enterprises, growing enterprises and infrastructure. It is often the acquisition, pooling and leveraging of capital that challenges most people with respect to Community Wealth Building.

Capital can also be used as means of securing other funding. The existing assets and capital of a place can be used in the right circumstances to secure more capital or used as a guarantor/security to debt funding.

Ownership

The antidote to lip service is to provide stakeholders with an actual stake.

Instead of large Corporations telling employees, customers and the community they are valued – when really they are not. Community Wealth Building proposes that enterprises align the interests of these stakeholders with the interests of the enterprise by providing them a pathway to an *actual* stake in the enterprise.

This can be done via mutual ownership, member ownership, employee ownership, customer ownership and other exotic ways. The important thing is that with a stake comes influence at the Board and Governance level. With an actual stake comes a sense of pride and duty. With an actual stake comes the competitive advantages we discussed earlier such as reduced costs of customer acquisition and increased lifetime customer value.

It may be that ownership by the community of stakeholders is small relative to the total capital requirements bought in by investors and that is ok. It may be that investors still need a fair return for their risk. None of those factors take away from the requirement for stakeholders to have ownership (an *actual* stake) of the business at the same rights level as outside investors.

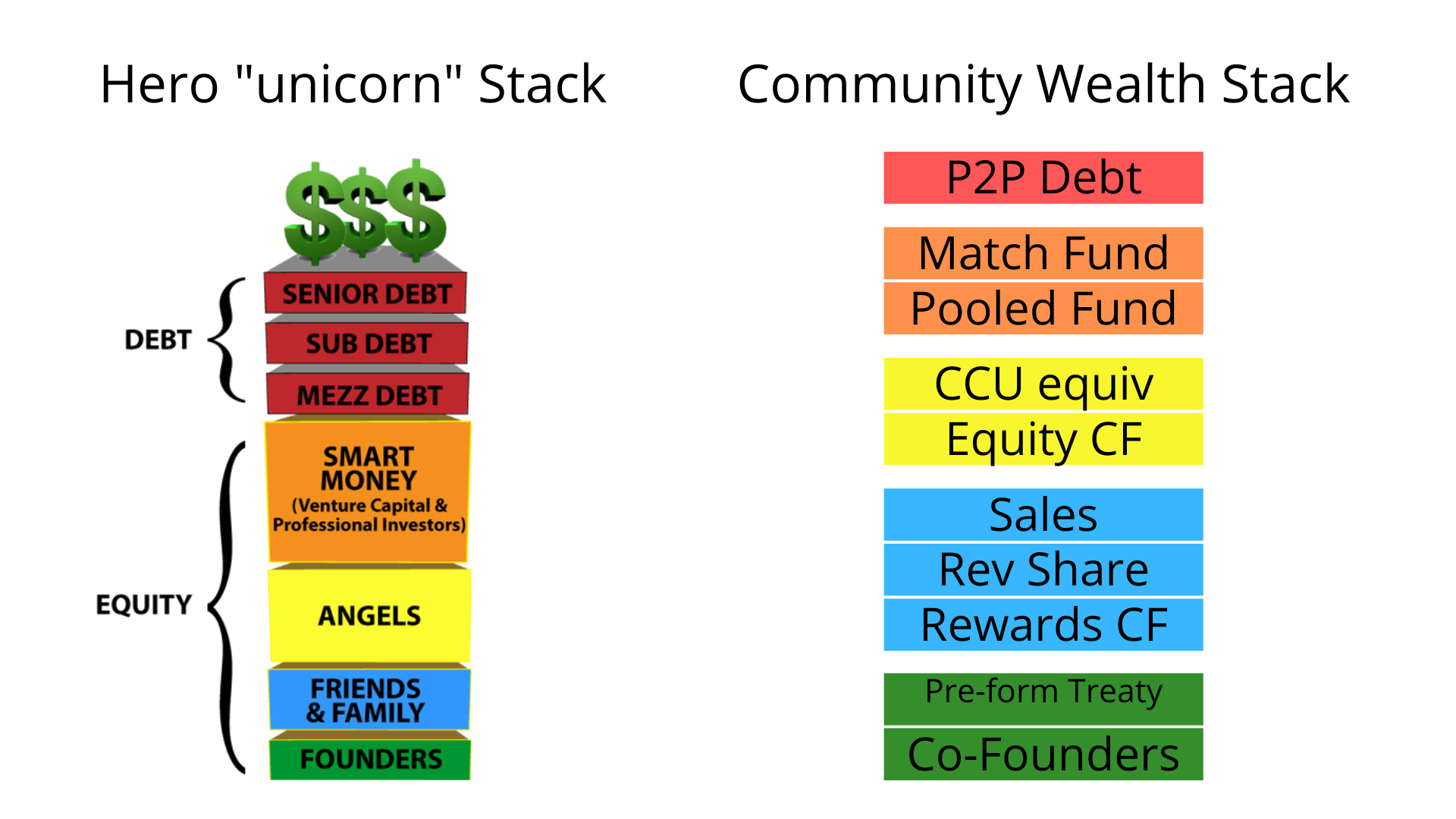

Stack

The “Stack” is also known as the “Capital Stack”. In Community Wealth Building, the concept of the “stack” is vital.

In order for a “stack” of capital to work effectively, the community must provide a ‘cornerstone’ amount that can then be multiplied by other capital using match funding. The initial or ‘cornerstone’ investment is often provided by crowdfunding or pooling of many small investments by people from the place.

As the amount of capital increases, so too does the variety of instruments and sources of capital at the disposal of the community.

Initially, Founders may put the first money into the stack. On top of that may come money from a crowdfunding raise or pre-sales event. On top of that may come a loan-based instrument, additional equity or outside investment. Any or all of those additional layers of stack on top. Some layers may be contingent on matching existing funds within the business. All in all, they act as multipliers to the available capital of the business.

Stage of Enterprise

The capital that gets stacked on top of each level changes for enterprises according to the stage of life of an enterprise.

In the early stages of a private company, the sweat work done by Founders in the pre-revenue stage is exchanged for equity. The risk : return ratio of sweat equity is generally well understood.

Pre-Revenue Co-operatives

By contrast, the pre-formation sweat by Founders in the early day of say a Co-operative, cannot come from sweat equity. Partly because the Co-operative won’t be formed and partly because Co-operative Shares don’t have capital gain. In fact, Co-operative shares are completely redeemable when a member leaves the Co-operative and so act more like a liability on the balance sheet.

Co-operatives nevertheless are a popular structure for Community-Owned businesses. Ethical Fields and incubator.coop pioneered an innovation to address this issue known as the “Treaty”. The “Treaty” system allows the vital pre-revenue, pre-formation work to be done and rewarded.

Exits

At the other end of the stage of life spectrum, the last money in the stack is usually pre-IPO (initial public offering). It is often from VC money or investment banks that look to cash in on a mature and growing business listing on the public market for a higher multiple.

In the case of a Community-Owned enterprise, particularly an enterprise providing local infrastructure such as Energy, Food, Water, Waste, Housing, Education and Social Services – these usually cannot list or IPO because they lack sufficient size and it is breaking from their context and service to Community Wealth.

Fortunately, there are circumstances where people from a region can direct their Superannuation into infrastructure assets of that region. This provides an ‘exit to Super’ instead of an ‘exit to the public markets’. These exits are desirable for Super because it gives a Super fund a long term asset that is de-risked and likely to have a long lifespan.

For Community investors, it provides an aligned exit and keeps the long-term value in their superannuation portfolio. This is shaping up as a great way for early investors who otherwise wouldn’t get an exit on their ownership a fair return for taking the initial risk and growing the value of the business during the earlier stages.

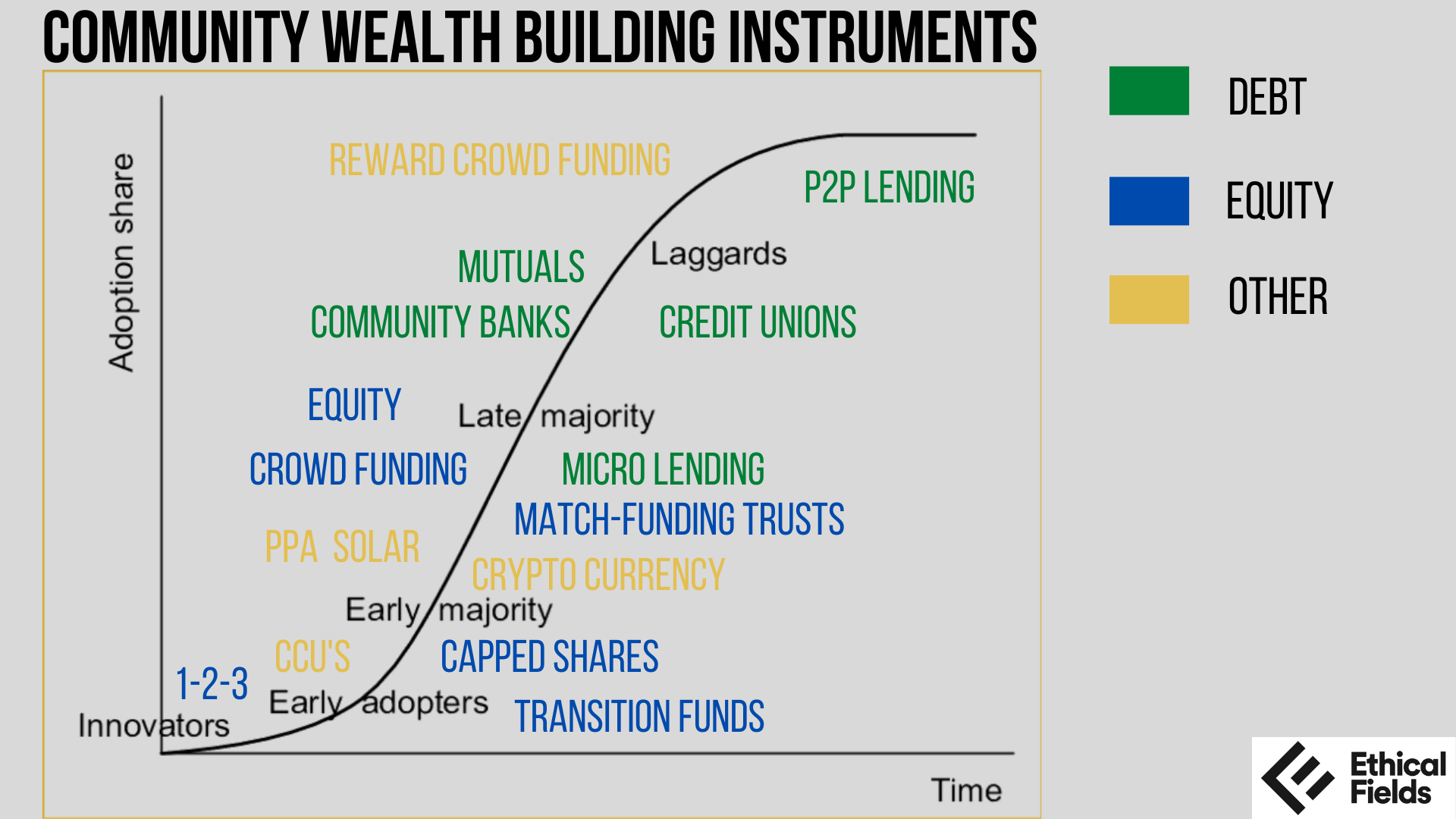

Instruments

The mechanism by which investments are made into Enterprises and Infrastructure is important and called the Investment Instrument or just Instrument.

Typical instruments include debt and equity instruments. You will be familiar with such as shares and loans.

Revenue-based Instruments

However, Community Wealth Building will often use less familiar and more appropriate instruments like revenue-based instruments.

An example of revenue based instrument is the 1-2-3 instrument. In this case, the community of investors will invest a dollar with a return coming in the form of a 2% commission on sales until $3 is repaid. Once the $3x return is provided to investors, the instrument expires and the earnings of the enterprise are no longer subject to a 2% commission.

Exotic Instruments

Blockchain-based, crypto instruments and more exotic instruments can also be used in Community Wealth Building.

Fair Return

The choice of instrument for each enterprise or infrastructure will vary depending on context, stage of life for the investment and risk : reward ratio. What is common to all instruments used is that they reflect a fair return as opposed to an accelerated return.

Moreover, the return may be less than those of private equity, VC and high interest loans to reflect the nature of the reduced risk. Lending, investing or supporting high tech businesses that want accelerated returns and “unicorn” status is hard and risky. Supporting businesses that locals patronise and have an *actual* stake in is far less risky and so the returns reflect that dimension.

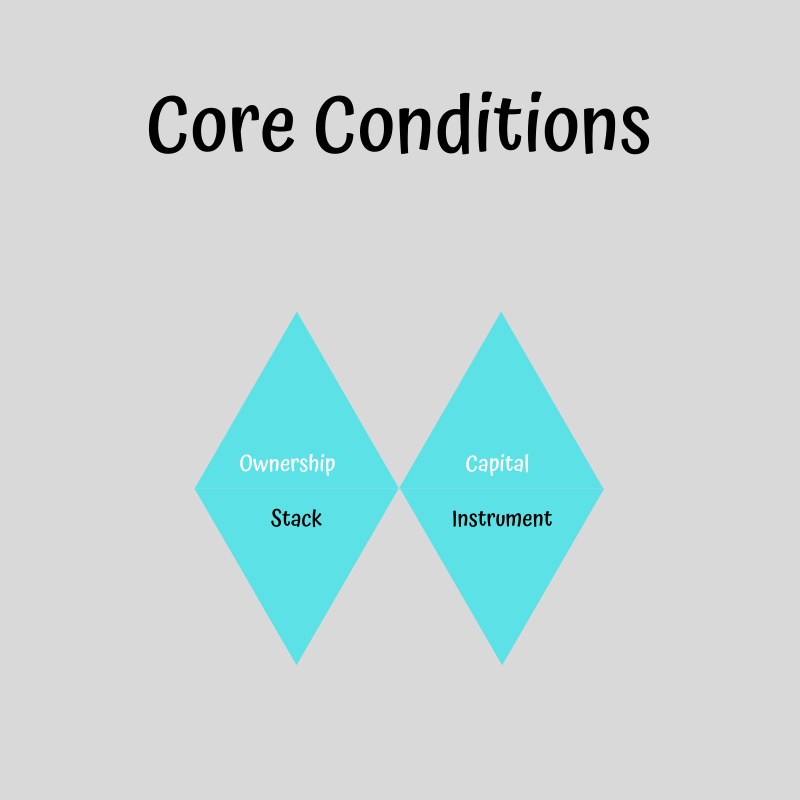

Core Conditions

The Core Conditions of the Community Wealth Building Pyramid describe the Capital, Stack, Ownership and Instruments that are used in transactions between the Community and the Enterprises and Infrastructure they support.

These elements support the Pinnacle Stone of Culture and Context. The Core Conditions provide robustness of the Community Wealth Building Pyramid.

Relationships

Community Wealth Building is often described as an exercise in relationship building.

Authentic relationships require time to develop and whilst they can be accelerated through purposeful communication, time and exposure are the basis of human to human relationships.

Thus, Community Wealth Building takes time to develop. It is not a quick fix.

Having said that, a Community that is purposeful in the creation of relationships and facilitates exchange between the community is likely to create at a faster rate.

The sort of relationships that can be encouraged through community engagement include:

- Regular in-person or digital events

- Hackathons, fix-a-thons and build-a-thons

- Incubator / Accelerators

- Experts in residence

- Catalytic events

- Turn around clinics

- Surveys

- Distributed organising software

- Social Media

- Local identities

Enterprises

Community-Owned Enterprises usually give stakeholders and *actual* stake via equity crowdfunding, employee ownership, customer ownership, member-ownership or form expressly as Co-operatives and Mutuals instead of as Corporations.

Local “Super Powers”

There are businesses and industries that thrive in some contexts because of the nature of the resources at their disposal in that location. In some areas, you get a concentration of human resources, physical resources or biological that provide that region and its enterprise an advantage, or “super power”.

An example would be Gippsland in Victoria is great for dairy industries, but Dubbo in Central Western NSW is not great for dairy.

Community Wealth Building taps into the inherent local Super Powers derived from the communities place in the world. These contextual local super powers can be diverse.

Localism As A General Advantage

An economic fact is that some things are just plain cheaper when the points of production and consumption are closer due to reduced transport costs, reduced waste, increased ‘fit’ or speed of delivery.

When you investigate the industries, enterprises and pieces of infrastructure this economic law applies to you find it matches neatly with things everyone needs. As just one of many examples look at the energy industry.

Our energy has historically come from digging up coal, oil and gas where it is found and then transmitting it through expensive polls and wires networks to every business and premises. The capital intensive nature of this industry has resulted in Australia in the creation of oligopolies. They have succeeded through scale and size.

However, with renewables being cheaper now (and cleaner and greener) a local energy enterprise has an economic advantage. In fact, the oligopolies that generated shareholder wealth from non-renewables aren’t at risk from a huge Corporate powered by the wind and sun they are at risk from 10,000 smaller community owned energy enterprises.

What applies so obviously to energy also applies to:

- Food

- Housing

- Education

- Water

- Waste

- Social Services

- Manufacturing, etc.

,Infrastructure

Community Wealth Building is growing due to changes in the economics of starting enterprises and changes to economics linked to the fundamentals infrastructure.

In many ways, these changes were highlighted in Australia by prolonged drought and bushfires, but were absolutely hammered home by the COVID -19 pandemic that showed just how little resilience and contingency were in place at a local level.

Food wasn’t on our shelves, supply chains were shown to be weak and toilet paper became something worth fighting over (to some).

Conventional Responses Are Too Blunt To Work

In the post pandemic recession, the response from government has been to invest in Manufacturing, Construction and Utilities. Whilst this will provide “jobs for the boys,” it shows clearly the gender deafness of such a response. The future is female and “jobs for the boys” won’t do the job of stimulating the broader economy.

Regenerative and Distributive

Community Wealth Building looks at infrastructure differently.

Local infrastructure needs to be regenerative and not degenerative, agriculture and food production needs to regenerative, energy source and usage needs to be regenerative. It’s simply not acceptable on a finite planet to do anything else.

Our kids’ future in the face of climate change and biodiversity loss demands it.

Community Wealth Building looks at infrastructure as way to also achieve greater equity, fairness, access and inclusion.

This is done by giving stakeholders an actual stake and investors a fair return instead of an accelerated return.

Over the last 70 years, infrastructure was driven by corporations, driven by capital efficiency, driven by profit maximisation and ignored people, place and environment. The future of infrastructure is to be regenerative and distributive and this bodes well for Community Wealth Building.

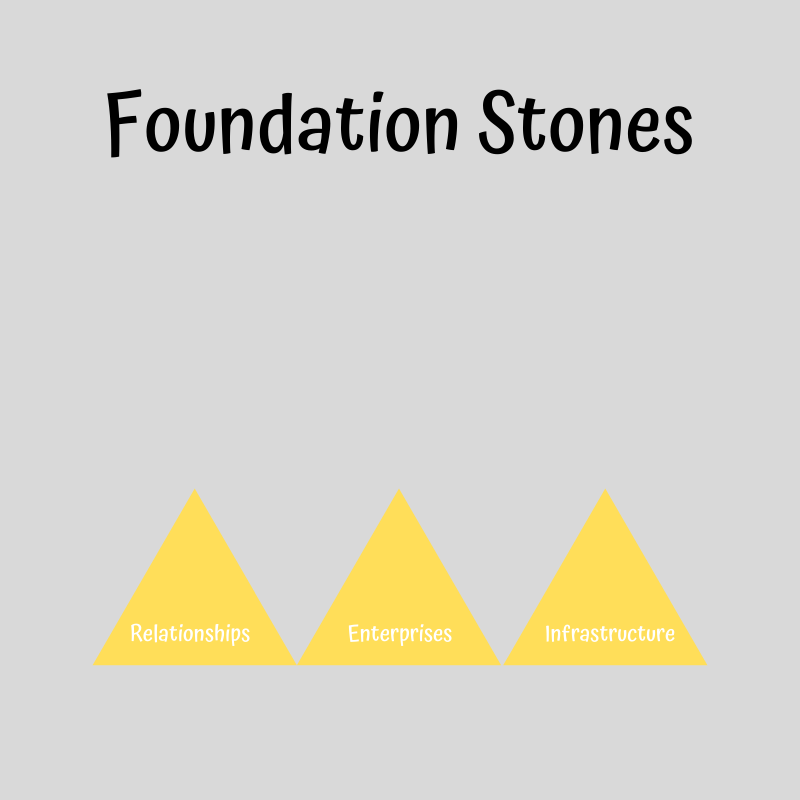

Foundation Stones

Foundation Stones

COVID-19 has reduced our physical ability to leave the place where we live. Whilst this has decimated industries such as tourism, arts and entertainment, it has provided a much needed focus on localism.

It is clear that the best ideas, software, designs can travel around the world via the internet. Fundamental things like jobs, industry, food, energy, water, social engagement and community are becoming local (again).

This phenomenon where ideas are global and production is local was first identified by Dr. Jose Ramos (an Ethical Fields Director) and is known as ‘Cosmo-Localism’. It ties directly into the foundations of Community Wealth Building and the foundations of the Community Wealth Building Pyramid.

The Layered View

Whilst no map is the territory – and no metaphor is 100% – the metaphor of the Community Wealth Building Pyramid exists to illustrate a few points. These include:

- The most important thing is people (community) and their importance is expressed via the Pinnacle Stone of the pyramid which is composed of the Culture and Context of a place;

- Supporting the basis of all wealth (and our pyramid metaphor) are the Relationships, Enterprises and Infrastructure of a region. When these are in place they support the creation of jobs, wealth, goods and services;

- The base of this pyramid could also be likened to Maslow’s hierarchy of needs. In both cases you must have secure food, energy, waste, shelter and water – fundamentals – on which to build upon. Without these in place the higher levels of consumerism, ego and significance just don’t get a look in;

- In between the base (Foundation Stones) of our pyramid and the Pinnacle Stone is the Core Conditions. In our case, these are often transactional in nature and speak to the Capital (Money), Stack (Multipliers), Instruments and Ownership required to make wealth flow and circulate.

This layered approach is useful, but it isn’t 100% accurate. The elements all interact with each other in dynamic ways. We hope it’s clear that it is just a metaphor and not ‘written in stone by Moses’.

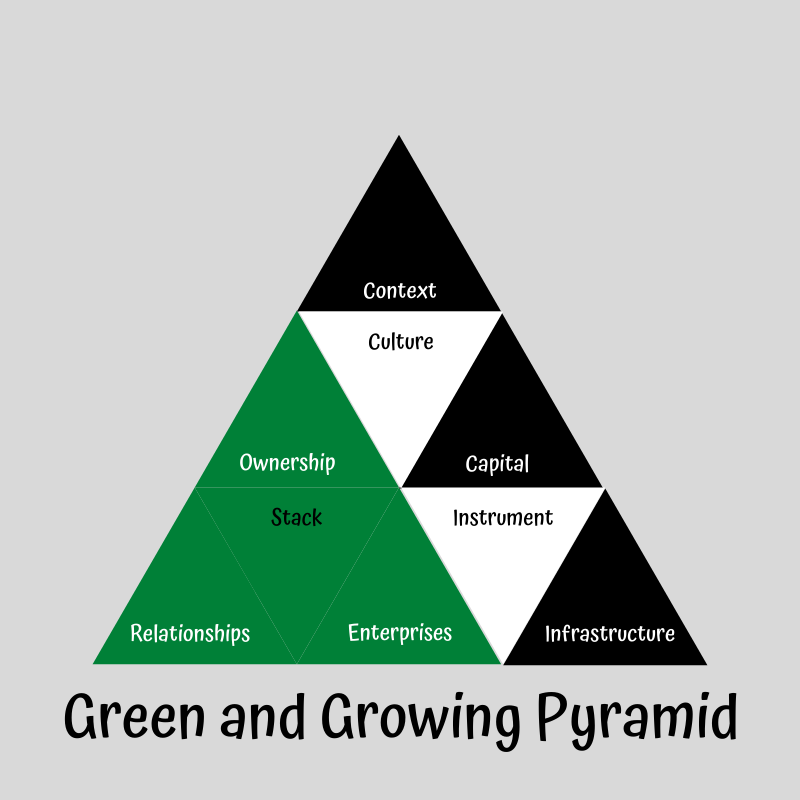

Green and Growing Sub Pyramid

As the “Me Economy” reduces in prevalence (or dies) it causes a void that the “We Economy” and Community Wealth Building needs to fill.

This requires new approaches to relationships, enterprises, ownership and funding models.

You can see this already playing out as energy behemoths like AGL, Origin are finding themselves replaced with new energy sources and hundreds of community-owned energy co-operatives and companies.

This is the domain where localised incubators, community entrepreneurship and distributed technology driven innovation will thrive.

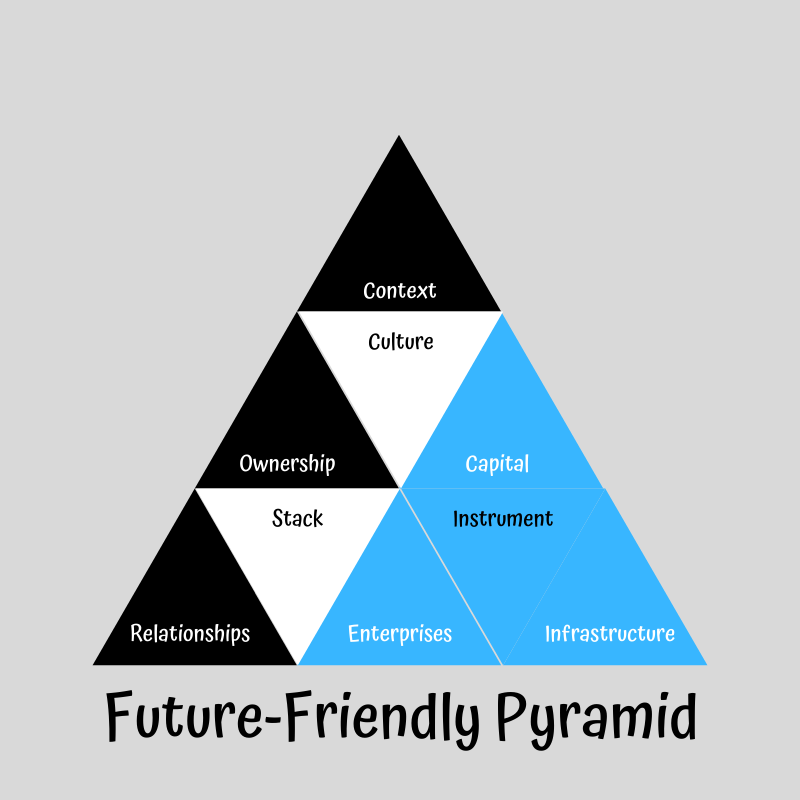

!…Future-Friendly Sub Pyramid

Whereas accelerated returns on capital was once the be-all and end-all of investment, this is changing. It is changing for several reasons:

- The COVID-19 induced global recession will see investors swap high yield for things that won’t devalue;

- You can already see the desire for capital to have impact beyond just a financial return.

The Future-Friendly Pyramid will be the domain of impact investors, local investors and the crowdfunding instruments that emerge to align the interests of stakeholders and capital.

Investors in this area will invest with novel instruments in new enterprises and pieces of infrastructure that suit the modern economic realities. These investments will be local and fundamental and de-risked by stakeholders having an *actual* stake.

These are exciting times.

Community Wealth Building Is the Future

Community Wealth Building is currently a niche concept, with a few tactical advantages. Over the coming period we predict a bigger system shock probably in the form of prolonged global recession will “flick the switch” and Community Wealth Building will undergo an increase in popularity due to systemic change. So much so that it will become the “new” normal. Or just ‘Normal’.

The benefits to people, communities and environments will be profound. In many cases the transition from the current system to the new may even be enjoyable!

The likelihood is better work via ownership, safer investment returns and demonstrable impact.

- As a consumer being able to spend your money, expend your labour and invest where you live is compelling;

- As an investor being able to invest alongside the community de-risks that investment. It makes it easier for investors to envisage the Enterprise(s) or piece of Infrastructure receiving their capital will be – because of the community – successful;

- As an employee being able to work closer to home and doing more meaningful work is likely to turn pay-check employees into engaged stakeholders.

Whilst this web page may not have answered all your questions, we hope that it has provided you with a view on Community Wealth Building and provided you with optimism for the future. Thank you for taking the time to read and please reach out if you need support from us here at Ethical Fields.